If you're Malaysian, you may wonder what are the action that you should take with the recent budget 2010 announcement. If you're not Malaysian, you can ignore this post. These are the KEY summary of Malaysia budget 2010 which most likely may impact or relevant to you.

For Credit Card Holders

If you're credit card holder and you've more than 1 credit card, go to bank directly and cancel your credit cards. Keep one credit card will be enough. This is due to the fact that you're now required to pay annual RM50 fees per credit card and RM25 for each supplementary card. What a crap?

My 2 cents: If RM50 is NOT too much for you or you lazy to go to bank, you can just wait and see what are the respond from the bank to play around with our government to waive this RM50.

For Property or Real Estate Owners

If you're the owner of property and this year is your fifth year of your purchase, sell your property as soon as possible before the end of 2009. If you can't sell, you can either sell it with 5% tax starting from Jan 2010 or just don't sell it at all and pray until the next announcement to waive it. Possible?

If you plan to sell your property which is within the 4 years of your purchase, don't sell it until next year Jan 2010 because the tax is more than 5%. Hold it until 2010 only sell your property. :)

Background: It used to tax 30% out of your property gain if you sell your property within 2 years, third year is 20%, fourth year is 15% and fifth year onward is NO TAX at all. With this recent 2010 budget announcement, everything will be stick to 5% regardless of what years you're selling. So it is good for those love to sell the property within 4 years but not good for those who love to sell their properties in long term (i.e after 4 years).

For Broadband Subscribers

If you have subscribed to any broadband services (e.g. streamyx), please keep your broadband bills receipt every month. This is due to the fact that you can get claim up to RM500 for tax relief starting from 2010 to 2012.

My 2 cents: This is probably the best news in this budget 2010 announcement. By the way, for student, there will be some incentive about PTPTN conversion to scholarship and free netbook package which I don't feel any great about it. Do you?

For EPF Contributors

If you're EPF contributors, basically you do NOT need to do anything. Your contribution will be reverted back to 11% if you opted to decrease your contribution previously. Also for 2010 tax filling, EPF and life insurance schemes to be increased to RM7K from RM5K.

My 2 cents: It is clear that this new scheme is good for everyone especially for those who has exceeded RM5K for many years.

For Self-Employed Folks

If you're self-employed, starting in 2010, you can go to the EPF office directly to open an EPF account and the government will top up 5% of every RM100 that you contribute. However the maximum amount that the government will pay you is RM60 which is RM300 for 5 years.

My 2 cents: What so big deal about this RM60 per annum? Isn't that too little? Should I say better than nothing?

p/s: Hope this helps and clear things up on what you should react to this Malaysia 2010 budget announcement. Good luck!

Minggu, 15 November 2009

Sabtu, 07 November 2009

How are people feeling about the economy now?

Indonesians don't see the economy as bad as it is blown up in the news. They still go on holiday, shop in malls, eat in food courts, travel out of down. Is this what is happening in Malaysia too?

Indonesians don't see the economy as bad as it is blown up in the news. They still go on holiday, shop in malls, eat in food courts, travel out of down. Is this what is happening in Malaysia too? Koreans feel quite positive about the economy now due to the stock index for the key companies in Korea (e.g. Samsung, LG and Hyundai) has risen and showed quite positive business result in the first half of 2009.

Koreans feel quite positive about the economy now due to the stock index for the key companies in Korea (e.g. Samsung, LG and Hyundai) has risen and showed quite positive business result in the first half of 2009. UK's people seem to be confused due to the conflicting message in the UK media - Things are going to get worse? Things are starting to look more positive? The recession is already over? While many become lost in negativity, there are equally many who have more positive feeling towards the economy.

UK's people seem to be confused due to the conflicting message in the UK media - Things are going to get worse? Things are starting to look more positive? The recession is already over? While many become lost in negativity, there are equally many who have more positive feeling towards the economy. Australians are caught in uncertain time which binds them into a state of inertia. In short, they don't know what to do to react to the current economy situation. Interest rates are low, services could not be better and etc. Majority of them do not expect economy upturn anytime soon.

Australians are caught in uncertain time which binds them into a state of inertia. In short, they don't know what to do to react to the current economy situation. Interest rates are low, services could not be better and etc. Majority of them do not expect economy upturn anytime soon. Americans have overwhelming feeling of uncertainty and it is unclear what the next is. No one thinks the economy is getting better. 5% of Americans say they're undecided on economy's direction. 13% of Americans say the economy is staying the same. 82% of Americans say the economy is getting worse.

Americans have overwhelming feeling of uncertainty and it is unclear what the next is. No one thinks the economy is getting better. 5% of Americans say they're undecided on economy's direction. 13% of Americans say the economy is staying the same. 82% of Americans say the economy is getting worse. Malaysians are optimistic about the economy. They feel secure, they make plans for the future, they get married, they buy cars and houses, they grow their wealth with stocks, bonds and unit trust. 58% of Malaysians think the economy will get better quickly. Based on my personal experiences (since I'm Malaysian), more than 70% of people around me buying new house and new car. So, are we really optimistic about the economy now?

Malaysians are optimistic about the economy. They feel secure, they make plans for the future, they get married, they buy cars and houses, they grow their wealth with stocks, bonds and unit trust. 58% of Malaysians think the economy will get better quickly. Based on my personal experiences (since I'm Malaysian), more than 70% of people around me buying new house and new car. So, are we really optimistic about the economy now?Summary

As you can see people from Asia are generally optimistic about the economy situation now as compared to American and European. What is your opinion on this?

Source: www.synovate.com

Posts that you may interested:

Minggu, 18 Oktober 2009

Are You Ready in 21st Century? Speak Chinese?

19th century belonged to England, 20th century belonged to United State, and 21st century belongs to China. Do you agree?

When I was first graduated around 10 years ago, I were not required at all to deal with China people and today it is almost like day-to-day activities that I have to deal with China folks. It happens to almost anyone around the world. Whether you're from Asia, Europe or U.S, I bet you're some how cannot run away from dealing China. Is that true?

I like the following quote from Jim Roger (i.e. he is an U.S. economist who currently stay in Singapore) who strongly believe that Asia has a strong potential.

The question is are we ready? Have you prepared yourself in 21st century? A very obvious answer is to prepare yourself is to “Learn Chinese”. Therefore, you can see the following trend which is happening today:

When I was first graduated around 10 years ago, I were not required at all to deal with China people and today it is almost like day-to-day activities that I have to deal with China folks. It happens to almost anyone around the world. Whether you're from Asia, Europe or U.S, I bet you're some how cannot run away from dealing China. Is that true?

I like the following quote from Jim Roger (i.e. he is an U.S. economist who currently stay in Singapore) who strongly believe that Asia has a strong potential.

"If you were smart in 1807 you moved to London, if you were smart in 1907 you moved to New York City, and if you are smart in 2007 you move to Asia."I know some of us (probably some of the economist as well) are still denying the fact (maybe not the fact yet to you?) that 21st Century belongs to China. But by the time you realize, will it be too late already? See the following interview of Jim Roger:

The question is are we ready? Have you prepared yourself in 21st century? A very obvious answer is to prepare yourself is to “Learn Chinese”. Therefore, you can see the following trend which is happening today:

- Not so smart people at least send their kids to Chinese school because they think they are probably too old to learn a new language.

- Smarter people take initiative to learn Chinese by themselves no matter how hard the language is.

- Very smart people marry Chinese people to fasten their learning process. That's why you see a lot of western people love Asia's girls. Hahaha... perhaps this not really their intention?

Minggu, 20 September 2009

Waive Late Credit Card Payment Fees and Charges

Do you aware that we can actually waive the credit card late payment charges? I wasn't aware of this until one day the bank officer called me to remind me that my credit card payment was due. So, I just simply tried my luck and asked him:

Wow! What a surprise? I think I have been all the while paying these fees due to the following careless reasons:

Steps to Waive Your Credit Card Late Payment Charges

I think they will only do this only if you have good track record and I'm using the HSBC credit card. I believe other banks should the same as well or else you can just tell them you would like to cancel the card. Hope this helps. :)

Related Posts:

p/s: I wonder if I should call them to waive those charges and fees that I have paid in few months back. Maybe I should?

Me: I have no idea the payment was due because I have not received any credit card statement in my letter box. Is there a way I can waive my penalty fees?

Bank Officer: Yes, you can waive the credit card late payment fees. Once you receive the statement, you can just give us a call to waive it.

Wow! What a surprise? I think I have been all the while paying these fees due to the following careless reasons:

- Forgot to make payment on time.

- Never received the credit card statement.

- Pay the wrong amount – less than the actual amount that I should pay.

Steps to Waive Your Credit Card Late Payment Charges

- Once you receive the statement, give them a call. The phone number is usually at the back of your credit card if you're not aware of it.

- Tell them that you want to waive your late payment charges. If they don't allow, tell them that you're going to use other credit cards and would like to cancel this credit card.

I think they will only do this only if you have good track record and I'm using the HSBC credit card. I believe other banks should the same as well or else you can just tell them you would like to cancel the card. Hope this helps. :)

Related Posts:

p/s: I wonder if I should call them to waive those charges and fees that I have paid in few months back. Maybe I should?

Minggu, 13 September 2009

What Determines the Value of Money?

We invented the money as medium of exchange but how are we going to determine the value of money? What do we mean by $1? What do we mean by $100? Who is in charge of determines the value of money?

The value of money has really no meaning at all until we know what is the capability or we call it purchasing power. Technically speaking, only goods or services has value and whether how much the goods or services are worth to you are very subjective from one person to another. Eventually, it is still back to the basic fundamental of economy, supply & demand to determine the value of the goods or services. Let's look at some history how we determine the value of the money...

Very Brief History of Money

Before paper money was introduced, money used to have its value when gold was still used as money (e.g. coins that made by gold). Then later the paper money was introduced to represent the gold. Thus, the Gold Standard Act was introduced, let's say $100 represent 1 ounce of gold. Having $100 is equivalent having 1 ounce of gold. You can basically exchange your $100 with 1 ounce of gold anytime as you wish. This is what it means by “Money is Backed By Gold”. So at that point in time, the value of money is determined by how many the gold you have.

The gold standard was then lasted until 1971 when “Fiat Money” was introduced. The key concept of “Fiat Money” system is money is no longer backed by any commodity (i.e. gold). This is the system that we're still using until today and it is totally based on our confident on the money itself. In other words, the value of money is now determined by your perception, impression or confidence on it. As long as WE THINK, how much money is worth, the money will worth that much. Of course, the “WE” here is not you and me but “EVERYONE” in the globe.

Simple Version (I hope) of Money History

Summary

Money in fact is a very complex topic and until today I'm still learning a very basic question of money: What is money? How money works? I try my best to make it as simple as possible.

To summarize this in few words, the value of money was used to determined by actual gold. However until now, the value of money is getting more complex in a sense that it no longer tights to gold but our impression or perception toward the money. That's why according to economist, only 8% of the world's currency exists as physical cash.

P/S: I talked about perceptive reality few years back and now this topic kind of links it back although my original intention has nothing to do with money. Think of it again, can I say the value of money is perceptive reality?

The value of money has really no meaning at all until we know what is the capability or we call it purchasing power. Technically speaking, only goods or services has value and whether how much the goods or services are worth to you are very subjective from one person to another. Eventually, it is still back to the basic fundamental of economy, supply & demand to determine the value of the goods or services. Let's look at some history how we determine the value of the money...

Very Brief History of Money

Before paper money was introduced, money used to have its value when gold was still used as money (e.g. coins that made by gold). Then later the paper money was introduced to represent the gold. Thus, the Gold Standard Act was introduced, let's say $100 represent 1 ounce of gold. Having $100 is equivalent having 1 ounce of gold. You can basically exchange your $100 with 1 ounce of gold anytime as you wish. This is what it means by “Money is Backed By Gold”. So at that point in time, the value of money is determined by how many the gold you have.

The gold standard was then lasted until 1971 when “Fiat Money” was introduced. The key concept of “Fiat Money” system is money is no longer backed by any commodity (i.e. gold). This is the system that we're still using until today and it is totally based on our confident on the money itself. In other words, the value of money is now determined by your perception, impression or confidence on it. As long as WE THINK, how much money is worth, the money will worth that much. Of course, the “WE” here is not you and me but “EVERYONE” in the globe.

Simple Version (I hope) of Money History

- Everyone used gold as money (i.e. medium of exchange).

- Bank came out a standard way to represent the gold (i.e. coins)

- Coins too heavy to carry around, bank introduced paper money to represent gold (i.e gold standard).

- Later on, we all confused with this piece of paper is valuable. We forgot that the paper money has value because it is backed by gold. We all started to love money...

- Bank created more paper money to satisfy our needs even without the actual gold they have.

- Sooner or later, money was no longer backed by the actual gold. “Fiat Monetary” is born.

- “Fiat Monetary System” works until today which means the money now gains its value through our impression and perception.

Summary

Money in fact is a very complex topic and until today I'm still learning a very basic question of money: What is money? How money works? I try my best to make it as simple as possible.

To summarize this in few words, the value of money was used to determined by actual gold. However until now, the value of money is getting more complex in a sense that it no longer tights to gold but our impression or perception toward the money. That's why according to economist, only 8% of the world's currency exists as physical cash.

P/S: I talked about perceptive reality few years back and now this topic kind of links it back although my original intention has nothing to do with money. Think of it again, can I say the value of money is perceptive reality?

Sabtu, 08 Agustus 2009

What is Money and Why It was Created?

In my previous post - simple way to explain the economy, I clearly explained that why people want to trade not only for the benefit of 2 parties but SYNERGY. So, no way we can stop trading. Because of trading, economy exists and so does the money was created too.

A lot of people in fact has already forgotten or have no idea of what money is and why it was created? These are the 2 top answers that I get when I throw the questions out:

What is Money?

Money is an agreement by everyone of us to be used as a medium of exchange. If you would like to use stone as your medium of exchange, then you can call the stone as money. Of course if you want to use a piece of papers as your medium of exchange, you can call this piece of paper as money. It was all started with stones, then gold, follows with coins and finally papers. But, why we want this medium of exchange?

Why Money Was Created?

The most direct precise simple answer is – money was created to make our life easier for the following reasons (that I can think of):

P/S: You may also want to read the Financial Big Bang Theory by Michael which I find it quite interesting on how the money was all started. I also like when he described the stranger house as bank.

Having said that, I don’t really sure if I agree when he mentioned the money is born due to the inconsistent trading. Can't we still define or standardize the trading agreement even without money existence?

I think money is born because the goods are too heavy (we don't want to carry them around) and trading with goods (i.e. technical term is known as barter trading) is lack of transferability and ability to divide.

A lot of people in fact has already forgotten or have no idea of what money is and why it was created? These are the 2 top answers that I get when I throw the questions out:

- Money is just a piece of paper.

- Money was created to make you rich.

- Money is just a piece of paper to make you rich!

What is Money?

Money is an agreement by everyone of us to be used as a medium of exchange. If you would like to use stone as your medium of exchange, then you can call the stone as money. Of course if you want to use a piece of papers as your medium of exchange, you can call this piece of paper as money. It was all started with stones, then gold, follows with coins and finally papers. But, why we want this medium of exchange?

Why Money Was Created?

The most direct precise simple answer is – money was created to make our life easier for the following reasons (that I can think of):

- Goods are too Heavy - If I want to trade my cow with your chickens, I need to bring along my cow to you and carry your chickens back. Therefore, money was created to solve this. E.g. I just need to carry a stone instead of cow to make a trade.

- Lack for Transferability - I have cow and you have chickens but you don’t want my cow and you want ducks. Then I need to look for people who have ducks that want my cow and exchange with them. Then, I only can use the ducks to exchange with your chickens. It goes very complicated when we involve more and more people. E.g. What if the one who has ducks wants only exchange with goats? So giving all this complication, a medium of exchange is defined which is called money.

- Difficult to Divide - I have 1 cow and I want to exchange 10 chickens with you but the fact that you only have 4 chickens. On the other I want to have ducks as well but the one has ducks agrees only to exchange 7 of his ducks with 1 cow. How can I chop my cow to both you? It is difficult or troublesome to divide my cow. So, a medium of exchange is later invented.

P/S: You may also want to read the Financial Big Bang Theory by Michael which I find it quite interesting on how the money was all started. I also like when he described the stranger house as bank.

Having said that, I don’t really sure if I agree when he mentioned the money is born due to the inconsistent trading. Can't we still define or standardize the trading agreement even without money existence?

I think money is born because the goods are too heavy (we don't want to carry them around) and trading with goods (i.e. technical term is known as barter trading) is lack of transferability and ability to divide.

Senin, 20 Juli 2009

Simple Way to Explain How Economy Works

I read this example from one of the economy book that I think it is the best example to explain how economy works as in general. The economy itself is very complex because it involves many people. What if I simplify the world to only 2 people with only 2 goods? Then, it makes this complex world way easier to be understood.

Classic Economy is Win-Win (1+1=2)

Assuming there are only 2 people in this world – farmer and rancher. Of course if farmer can only produce potatoes and rancher can only produce meat, it is obviously they can exchange their goods for the benefits each others. When they start exchanging, this is called trading. They start trading for the purpose of mutual benefit - this is called WIN-WIN.

With Trading Gain (Farmer & Rancher Start Trading)

Conclusion

Economy is everything about producing goods or services, exchanging goods or services or simply called trading.

P/S: As you can see, the very original reason we trade is for synergy or at least win-win? Now, what is your reason to trade? You just want to Win! But, are you winning?

By the way, you may also interested to read the Simple Way to Explain Subprime Crisis.

Classic Economy is Win-Win (1+1=2)

Assuming there are only 2 people in this world – farmer and rancher. Of course if farmer can only produce potatoes and rancher can only produce meat, it is obviously they can exchange their goods for the benefits each others. When they start exchanging, this is called trading. They start trading for the purpose of mutual benefit - this is called WIN-WIN.

Modern Economy is Synergy (1+1 >=3)

Let’s make this a little bit complicated that farmer and rancher can produce both meat and potatoes. Even though farmer specialty is to produce potatoes, Rancher can somehow still produce more meat and potatoes than the farmer.

Let’s look at the table below to understand the capability of these 2 guys can produce meat and potatoes in 8 hours:

In order to enjoy both meat and potatoes:

As you can see, Rancher produces more meat and more potatoes than farmer. Now the question is:

Let’s make this a little bit complicated that farmer and rancher can produce both meat and potatoes. Even though farmer specialty is to produce potatoes, Rancher can somehow still produce more meat and potatoes than the farmer.

Let’s look at the table below to understand the capability of these 2 guys can produce meat and potatoes in 8 hours:

| Meat | Potatoes | Comment |

| Farmer | 8 oz | 32 oz | Farmer’s capability to produce meat and potatoes in 8 hours. |

| Rancher | 24 oz | 48 oz | Rancher’s capability to produce meat and potatoes in 8 hours. |

In order to enjoy both meat and potatoes:

- Farmer takes 4 hours to produce 4 ounces (i.e 8 oz /2) of meat and another 4 hours to produce 16 (i.e. 32 oz / 2) ounces of potatoes

- Rancher takes 4 hours to produce 12 ounces (i.e 24 oz /2)of meat and another 4 hours to produce 24 ounces (i.e 48 oz /2)of potatoes

As you can see, Rancher produces more meat and more potatoes than farmer. Now the question is:

- Should the rancher continue to trade or exchange goods with farmer?

Obviously no, right? However, Rancher thinks of a way to benefit to both of them to enjoy more meat and more potatoes. How does that possible? Let’s look at the conversation below:

Summary of the Conversation

Perhaps you’re also confused with the conversation. Let’s look the gain from trade table below to understand the confusion:

Without Trading Gain (Farmer & Rancher work independently)

Rancher: Hey farmer! Why you do something that you’re not good at?

Farmer: I want to enjoy the meat as well, I have to.

Rancher: I have an idea for both of us to enjoy more meat and more potatoes than we are producing now.

Farmer: Are you kidding? Don’t bluff me…

Rancher: No bluffing… listen carefully. Why don’t you 100% focus on producing potatoes and you exchange the potatoes with my meat?

Farmer: You must be insane! I got to work. Don’t talk non-sense to me anymore.

Rancher: Wait wait… If you’re doing full time producing potatoes, you can get 32 ounces of potatoes right? If you give me 15 of those 32 ounces, I’ll give you 5 ounces of meat in return. So now, you have 17 (i.e. 32 – 15) ounces of potatoes and 5 ounces. See? Now you enjoy 1 extra ounce of potatoes and 1 extra ounce of meat? Amazing, isn’t it?

Farmer: That’s sounds great. Why the hell you want to do that? If I enjoy more, then you must be enjoying less.

Rancher: No, not really. I enjoy MORE as well. See, I spend 6 hours to produce 18 (i.e. 24 oz / 8 hours X 6 hours) ounce of meat and spend 2 hours to produce 12 (i.e. 48 oz / 8 hours X 2 hours) ounces of potatoes. I exchange 5 ounces of meat with 32 ounces of potatoes that you have. So now I have 13 (i.e. 18 – 5) ounces of meat and 27 (i.e. 12 oz + 15 oz) ounces of potatoes. You see? I get extra 1 ounce of meat and extra 3 ounce of potatoes.

Farmer: Wow! This is so cool! But how does that work? I’m confused.

Rancher: That is MAGIC! :D

Summary of the Conversation

Perhaps you’re also confused with the conversation. Let’s look the gain from trade table below to understand the confusion:

Without Trading Gain (Farmer & Rancher work independently)

| Meat | Potatoes | Comment |

| Farmer | 4 oz | 16 oz | Farmer splits the 4 hours to produce 4 oz of meat and another 4 hours to produce 16 oz of potatoes. |

| Rancher | 12 oz | 24 oz | Rancher splits the 4 hours to produce 12 oz of meat and another 4 hours to produce 24 oz of potatoes. |

With Trading Gain (Farmer & Rancher Start Trading)

Meat | Gain from Trade | Potatoes | Gain from Trade | Comment | |

| Farmer | 5 oz | + 1 oz | 17 oz (32 – 15) | + 1 oz | Farmer 100% focus to produce 32 oz of potatoes and exchange 15 oz of potatoes with 5 oz of meat. |

| Rancher | 13 oz (18 – 5) | + 1 oz | 27 oz (12 + 15) | + 3 oz | Rancher spends 6 hours to produce 18 oz of meat and spends 2 hours to produce 12 oz of potatoes. |

Conclusion

Economy is everything about producing goods or services, exchanging goods or services or simply called trading.

- Classic economy is trading with the win-win benefits.

- Modern economy is trading with the achieving synergy in both parties.

P/S: As you can see, the very original reason we trade is for synergy or at least win-win? Now, what is your reason to trade? You just want to Win! But, are you winning?

By the way, you may also interested to read the Simple Way to Explain Subprime Crisis.

Minggu, 05 Juli 2009

Shall I travel during this H1N1 (Swine Flu) outbreak?

Time flies and I’m going to travel to Europe again in this coming Friday. The last trip I only stayed in Ireland for 3 weeks and this round I’m going to travel outside of Ireland for about 2.5 weeks.

The countries that I going to visit are:

Yes, I decided to travel during this H1N1 (Swine Flu) outbreak because:

As you can see, a very cute thing about human is:

So, you may come to this blog by searching the net and looking for an answer but the fact that you had already made a choice. Don’t you think so?

P/S: Okay, see you guys and I'm going to travel in 5 more days. I probably won’t be blogging for a while - thinking to completely run away from work and laptop (still thinking whether I should bring laptop). I hope this won't be my last post though. :D All the best to all of you!

The countries that I going to visit are:

- United Kingdom (London) – Travel by Air and Car.

- France (Paris) – Travel by Air and Train

- Scandinavia (Norway, Denmark, Sweden) – Travel by Air and Train

Yes, I decided to travel during this H1N1 (Swine Flu) outbreak because:

- Visiting these countries is probably my last chance that I have in my entire life.

- Influenza A - H1N1 (Swine Flu) is not really a deathly disease.

- WHO says travelling is safe! :) Really?

- I believe I have strong immune system. :D

- I will eat a lot of fruits, vegetable to build up my immune system before and during the trip.

- I will keep my good hygiene and avoiding touch my month and nose.

- What else?

- We all like to make a decision first then only we look a reason or excuse why we make such decision.

So, you may come to this blog by searching the net and looking for an answer but the fact that you had already made a choice. Don’t you think so?

P/S: Okay, see you guys and I'm going to travel in 5 more days. I probably won’t be blogging for a while - thinking to completely run away from work and laptop (still thinking whether I should bring laptop). I hope this won't be my last post though. :D All the best to all of you!

Minggu, 14 Juni 2009

Do you think Direct Selling is SCAM?

It has been quite some time I’ve never had a chance talk to a direct selling person. Until recently, someone just started to approach me about direct selling. It is actually my neighbour insisted want to talk to me. I rejected at the first place but she told me that it isn’t anything about directly selling. Huh?

What is My First Impression?

Conversation at that Night

Is direct-selling scam?

Conclusion

I really don’t like most of the direct selling people (of course not all of them). They do not “STRAIGHT to the POINT” and talk a lot (really a lot) before go directly to the point. Their real intention deeply in their heart is want you to become their down line member rather than helping you to buy the right products that you really need.

At the end of our meeting, she did mention that buying direct sell products is actually cheaper and in fact we can save a lot and we can enjoy high quality of the product at the same time. It is cheap with good quality. I told her, if this is really true, I will 100% support your product! I really do…

What do think about direct selling or multi-level marketing? Do you think they’re SCAM?

Me: What is it?

X: It is about a system.

Me: What system? Direct selling system?X: No, it has nothing to do with direct selling. I’m going to introduce you a system. That’s why we need to talk. Can we meet tomorrow night to discuss in more detail?Me: Some kind of the business? You want me to invest?X: No, it is a system that I want to introduce you. So tomorrow night, okay?Me: Okay, sure. (Just to give face since she is my neighbour. Don’t want to spoil our relationship)

As what usually direct selling people do, they just want to talk to you no matter what. That is their first ultimate goal to approach their potential customers by not telling you first what they plan to sell you.

What the heck? You're selling stuff but you don't want to tell me what you're selling? Some more you lie... I dislike the ways they do things that doesn’t have the integrity at all. In the conservation as you can see, she kept avoiding my questions.

Conversation at that Night

Me: So, let’s start. I’m very curious about the system that you mentioned yesterday that has nothing to do with direct selling.

X: Yes, have you heard of a system?

Me: Huh? What kind of a system?

X: Before we start, you seem like you don’t like direct selling. Would you tell me why? (not answering my question again...)

Me: Yes, I can’t sell. That’s why I don’t like to sell stuff because this is simply not my strength. Unless the product is very good, then I probably can sell.

X: I see. If you don’t like to sell, you can just refer the product to someone else. For example, when you use a very good product and you definitely will share it with others, right? You don’t need to sell at all.... (Blah blah blah…. for few minutes)

Me: Yupe, you’re right. So, what is the “System” about? (not yet answering my question again about the system)

…

- We talked about all these non-sense for about 30 minutes back and forth and she had not yet explained to me what the system is about.

- She asked a lot of questions like where I buy my toothpaste, my grocery and etc. Then later she started talking about product that directly from the producer to consumers without those advertisement and etc.

- Hey, isn't that all about direct selling right that they usually claim that their products without the charges of marketing, stocking, profit and etc?

Me: So, what is the system? I know about all these, what you have been saying so far it seems like a direct selling to me. What do you mean by system at the first place?...

- She started to explain the benefits of joining the direct sell company and how to enjoy the benefits from collecting a point.

Me: So, this is a direct-selling "SYSTEM" in your company? So is this what you meant by the "SYSTEM" where you can also collect points and use that points for certain benefits?

- This takes another 15 minutes and I stopped her half way immediately.

X: “Hmm… kind of yes, As you see the "SYSTEM" is very powerful”. (she continued to talk about the "SYSTEM’s crap….)Me (In My Thought Only): Why you don't want to tell at the first place? Why don't you just say the following:

- Our company has a new system which his a totally different concept than the conventional direct-selling company. Do you want to hear about it in detail, maybe you're interested?

As you probably know, direct selling is not a scam legally. It is a multi-level marketing (i.e. MLM) business with real products. Those pyramid scheme companies (e.g. swisscash) without the real products are only considered illegal. Although they’re not SCAM legally, the way the agent approaching me at least does look like a SCAM to me due to the fact that they have low integrity and unprofessional. What do you think?

Conclusion

I really don’t like most of the direct selling people (of course not all of them). They do not “STRAIGHT to the POINT” and talk a lot (really a lot) before go directly to the point. Their real intention deeply in their heart is want you to become their down line member rather than helping you to buy the right products that you really need.

At the end of our meeting, she did mention that buying direct sell products is actually cheaper and in fact we can save a lot and we can enjoy high quality of the product at the same time. It is cheap with good quality. I told her, if this is really true, I will 100% support your product! I really do…

What do think about direct selling or multi-level marketing? Do you think they’re SCAM?

Sabtu, 06 Juni 2009

Simple Way to Explain “Rule of 72”

Perhaps the most useful financial formula is the “Rule of 72”. It is a simple way to “estimate” how long it takes to double your money without using the complex financial formula.

However before you even want to know about this rule of 72, the fist thing you want to know is the compound interest. This is due to the fact that, this rule only applicable for your investment that based on the compound interest (which means you reinvest your interest return into your principal).

How much I can double my investment return of $10k with 8% interest?

Answer 1:

72 / 8% = 9 years.

If you’re now 25 years old, you will have $20k at the age of 34 years old.

Example 2: Inflation

I spend $2k per month. How long that my spending will inflate until $4k with my personal inflation rate of 2%?

Answer 2:

72 / 2% = 36 years.

If you’re now 25 years old and when you’re 61 years old later, you need to have at least $4k for your monthly spending.

Example 3: Goal Setting

I’m now 30 years old and I have $100k cash now to invest. I want to have $200k in 2 years time. What is investment return that I should get to reach my goal?

Answers 3:

72 / 2 years = 36%

So if you want to earn the extra $100k in 2 years time, your investment return is expected to have at least 36% returns.

However before you even want to know about this rule of 72, the fist thing you want to know is the compound interest. This is due to the fact that, this rule only applicable for your investment that based on the compound interest (which means you reinvest your interest return into your principal).

72 / Interest Rate (p.a.) = Years to Double Your $Example 1: Investment

How much I can double my investment return of $10k with 8% interest?

Answer 1:

72 / 8% = 9 years.

If you’re now 25 years old, you will have $20k at the age of 34 years old.

Example 2: Inflation

I spend $2k per month. How long that my spending will inflate until $4k with my personal inflation rate of 2%?

Answer 2:

72 / 2% = 36 years.

If you’re now 25 years old and when you’re 61 years old later, you need to have at least $4k for your monthly spending.

Example 3: Goal Setting

I’m now 30 years old and I have $100k cash now to invest. I want to have $200k in 2 years time. What is investment return that I should get to reach my goal?

Answers 3:

72 / 2 years = 36%

So if you want to earn the extra $100k in 2 years time, your investment return is expected to have at least 36% returns.

Summary

Rule of 72 gives you a quick estimation on what my interest rate should be or how many years that I need to double my return. It applies to anything that as long as it is based on the compound interest principle (e.g. inflation, saving, investment and even goal setting). Hope this helps.

Jumat, 29 Mei 2009

Why Compound Interest Is So Powerful?

In fact, it is nothing that really powerful about compound interest even though Albert Einstein has quoted the following:

How Compound Interest Works?

Compound interest simply means to REINVEST your investment return into your total investment amount. Total investment amount is called PRINCIPAL in personal finance. Let’s say I invest $100 with 10% return. The investment return is $10 and I used back this money to reinvest, so my total investment or new principal value is now becoming $110. Second year, I reinvest at $121 (new principal amount). In following years, my investment return grows exponentially…

Note: Compound interest is also applicable to loan or mortgage interest. E.g. Your loan principal amount will grow exponentially if you don’t reduce your loan principal.

The Key is Exponential Growth

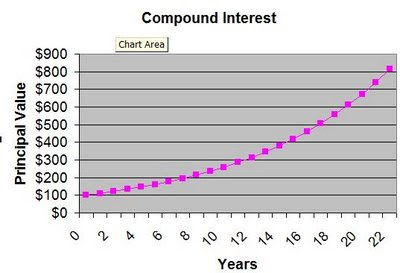

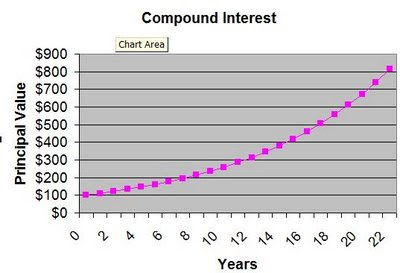

Your principal grows exponentially with the compound interest, that is how the magic works and that’s why we like to say it is powerful. Looks at the chart below:

This is usually how those insurance agents use this magic to convince or trick you to buy their insurance especially for those non-term insurance policy.

In personal finance, everything is about compound interest whether you have car loan, housing loan, credit card loan, invest in stocks, unit trust, fixed deposit or the most important element in personal finance– inflation rate.

Summary

Compound interest is really that powerful by itself or we don’t understand it that makes it powerful or we ignore it that makes it powerful? What do you think?

“Compound Interest is the greatest force in the world”Einstein, are you sure about that? The compound interest itself is not powerful but it is the human mind or emotion to make it the powerful one. If I were to say, what the greatest force in the world is, I will say it is “Human Mind” – our mind. Why the compound interest can become so powerful is due to the fact that:

“We do not know how it REALLY works or we simply IGNORE it!”

How Compound Interest Works?

Compound interest simply means to REINVEST your investment return into your total investment amount. Total investment amount is called PRINCIPAL in personal finance. Let’s say I invest $100 with 10% return. The investment return is $10 and I used back this money to reinvest, so my total investment or new principal value is now becoming $110. Second year, I reinvest at $121 (new principal amount). In following years, my investment return grows exponentially…

Note: Compound interest is also applicable to loan or mortgage interest. E.g. Your loan principal amount will grow exponentially if you don’t reduce your loan principal.

The Key is Exponential Growth

Your principal grows exponentially with the compound interest, that is how the magic works and that’s why we like to say it is powerful. Looks at the chart below:

In 7 years, I can X2 my money - ~$200 (see also Rule of 72). In 12 years, I can X3 my money - ~$300. In 15 years, I can X4 my money - ~$400. In 17 years, I can X5 my money = ~$500. In 19 years, I can X6 my money - $600. As you can see, the longer term I have the, shorter the period that I need to double-up my money. Can you see this MAGIC?

This is usually how those insurance agents use this magic to convince or trick you to buy their insurance especially for those non-term insurance policy.

In personal finance, everything is about compound interest whether you have car loan, housing loan, credit card loan, invest in stocks, unit trust, fixed deposit or the most important element in personal finance– inflation rate.

Summary

Compound interest is really that powerful by itself or we don’t understand it that makes it powerful or we ignore it that makes it powerful? What do you think?

Jumat, 15 Mei 2009

Dollar Cost Averaging is Stupid?

It is funny that some people actually say that the “dollar cost averaging technique” (also known as DCA) is a stupid method. They start “giving up” using this technique especially when they make a lost in investing in Unit Trust or Mutual Funds.

What is the purpose of dollar cost averaging?

Dollar cost averaging is designed to be used by stupid people who doesn’t know exactly when to sell high and buy low. Also, this technique is designed for Long Term Investment Strategy – 5 to 7 years for example. If you’re using this method as a short-term investment strategy, then you use it for the wrong purpose. So now the question is - do you know when to sell high and buy low? Do you know the market goes up or down tomorrow? If you don’t know, use dollar cost averaging. But, would DCA guarantee Return of Investment (ROI)?

Obviously, when you think you’re stupid you use this method. Because of this method is designed for stupid people like you and me, therefore once you’re start using this method, you’re not considered as stupid anymore – you’re smart!

Here you go the reasons when you should use DCA:

Summary

Dollar cost averaging is in fact a perfect method to guarantee the investment return as long as the market or stock or unit trust that you buy goes up in long run. Most importantly it reduces the risk when the market goes down and you can earn back your investment when the market goes up again.

“Dollar cost averaging is stupid! It doesn’t work and so far I have made a lost -30% out of my unit trust investment. What the heck? I should buy low and sell high, that’s the perfect technique!”I used to heard of this kind of statement and RECENTLY getting more and more due to fact that the recent economy recession caused by the subprime crisis that most unit trust or mutual fund make a lost around -20% to -30%. More and more people start complaining about this “Dollar Cost Averaging” method is stupid and they regret to follow this technique which they used to believe that it is 100% guaranteed method as told by their agents. 100% guaranteed? Who told you that?

Dollar cost averaging is not stupid, okay?

Technically dollar cost averaging is NOT stupid but it was designed for STUPID people if you insist me to use the “stupid” word. So if you think you’re not stupid – know exactly when to sell high and buy low, don’t use Dollar Cost Averaging method. If you do, then you’re really stupid because Dollar Cost Averaging method is not designed to be used this way especially when you know when to sell high and buy low. So, do you think you're stupid or not?

Technically dollar cost averaging is NOT stupid but it was designed for STUPID people if you insist me to use the “stupid” word. So if you think you’re not stupid – know exactly when to sell high and buy low, don’t use Dollar Cost Averaging method. If you do, then you’re really stupid because Dollar Cost Averaging method is not designed to be used this way especially when you know when to sell high and buy low. So, do you think you're stupid or not?

What is the purpose of dollar cost averaging?

Dollar cost averaging is designed to be used by stupid people who doesn’t know exactly when to sell high and buy low. Also, this technique is designed for Long Term Investment Strategy – 5 to 7 years for example. If you’re using this method as a short-term investment strategy, then you use it for the wrong purpose. So now the question is - do you know when to sell high and buy low? Do you know the market goes up or down tomorrow? If you don’t know, use dollar cost averaging. But, would DCA guarantee Return of Investment (ROI)?

How dollar cost averaging works?

It is a very simple technique that you just need to invest fixed amount of money periodically (usually monthly). You can apply this whether to stock or unit trust or any kind of investment. This technique basically forces you to:

It is a very simple technique that you just need to invest fixed amount of money periodically (usually monthly). You can apply this whether to stock or unit trust or any kind of investment. This technique basically forces you to:

- Buy MORE units investment at lower prices

- Buy LESSER units investment at higher prices.

When you want to use dollar cost averaging?

Obviously, when you think you’re stupid you use this method. Because of this method is designed for stupid people like you and me, therefore once you’re start using this method, you’re not considered as stupid anymore – you’re smart!

Here you go the reasons when you should use DCA:

- Don’t know when to sell high and when to buy low. You can use one lump sum investment strategy if you know exactly the lowest and the highest of the market

- Only if you BELIEVE your investment will goes up in long term - 5 to 7 years or even more years. If you intent to use DCA for short term investment, let’s forget about it

- Continue to use DCA even during market downtrend. Don't stop or complain about DCA method when you make a lost in investment. DCA is designed for you to even to invest more (buy more units) during market downtrend. Unless, you're kind of sure that the market will never be recovered again, you can give up DCA method then.

Summary

Dollar cost averaging is in fact a perfect method to guarantee the investment return as long as the market or stock or unit trust that you buy goes up in long run. Most importantly it reduces the risk when the market goes down and you can earn back your investment when the market goes up again.

How can this perfect method being perceived as a stupid? Don’t fall into the common trap that does not understand the purpose of DCA method. Use a right method for a right purpose is SMART, use a right method for a wrong purpose is STUPID. Don't you think so?

In personal finance, as long as we do it right we can be as stupid as possible. That's is something FUN about personal finance. Have fun!

Jumat, 01 Mei 2009

Tax Relief Tips for Critical Illness Life Insurance in Malaysia

Few days ago, I had supper with some old friends and I realized that many of them do not aware that they can actually claim the "36 critical illness" life insurance under ‘Medical Insurance” category when they’re filling for tax. But it is already too late for them, maybe for you too? I think this is worth to share with you guys ...

If you buy the "36 Critical Illness" life insurance from Great Eastern or they probably call it "Supreme Livin’Care Plus", you can claim up to 60% of your total premium paid under the education and medical insurance category (limit is RM 3000). However, of course you also can claim up to 100% of your total premium paid under life insurance and EPF category (limit is RM 6000).

Many people think that this critical illness life insurance can only be considered as life policy for tax relief but this is not true. It can be considered as medical policy as well for tax relief. Sometimes especially when you have fully utilized the RM 6000 limit (life and EPF), you can still claim the 60% under the medical insurance. At least this is true for Great Eastern and I'm not sure other insurance companines.

When you receive the tax relief statement from Great Eastern every year, it basically categorizes the insurance into 4 categories (stated at the back of your statement):

If you buy the "36 Critical Illness" life insurance from Great Eastern or they probably call it "Supreme Livin’Care Plus", you can claim up to 60% of your total premium paid under the education and medical insurance category (limit is RM 3000). However, of course you also can claim up to 100% of your total premium paid under life insurance and EPF category (limit is RM 6000).

Many people think that this critical illness life insurance can only be considered as life policy for tax relief but this is not true. It can be considered as medical policy as well for tax relief. Sometimes especially when you have fully utilized the RM 6000 limit (life and EPF), you can still claim the 60% under the medical insurance. At least this is true for Great Eastern and I'm not sure other insurance companines.

When you receive the tax relief statement from Great Eastern every year, it basically categorizes the insurance into 4 categories (stated at the back of your statement):

Life100% of premium paid are eligible for tax relief as life policyEducation/Life100% of premium paid are eligible for tax relief as education or life policyMedical/Life60% of premium paid are eligible for tax relief as medical policy. 100% of premium paid are eligible for tax relief as life policy

Medical100% of premium paid are eligible for tax relief as medical policy.

The "36 critical illness" life policy or the "supreme livin'care plus" life policy in Great Eastern is categorized under Medical/Life. If you missed it this round, don't make a same mistake next year. Hope this helps. :D

Sabtu, 21 Maret 2009

How to calculate housing and car loan interest?

Perhaps you may not aware the way our car loan interest and the housing loan interest are calculated differently.

Housing loan interest is calculated based on the principal of the loan that you have and the interest is not fixed. Principal of your loan is the amount of money that you still owe the bank.

Car loan interest is calculated based on the total amount of loan that you have and the interest is fixed.

Housing Loan

For example, you borrow $50K from a bank at 5% interest rate for 5 years.

1 year housing loan interest:

Depending on the monthly installment amount that you have, let’s say $1K per month, you will reduce your principal from $50K to:

Renew Principal $ after first payment:

Second month housing loan interest:

Total car loan interest rate:

Car Loan

On the other hand, you have car loan of $50K at the interest rate of 5% for 5 years term.

1 year car loan interest:

The only difference between the housing loan versus car loan is the car loan interest rate is fixed for every month. Therefore:

First month car loan interest:

Total car loan interest rate:

Conclusion

Because the car loan does not reduce the principal amount and the interest is fixed through the year, therefore the interest is higher than the normal housing loan interest calculation provided the interest rates are the same.

So usually what people do when they have housing loan is try to reduce the principal amount as early as possible either by flexible-loan package or early extra payment. It doesn't work for car loan because the interest is fixed and the total interest that your are going to pay is 1.9 X higher than housing loan interest.

You may also want to know that the car value is depreciating every year after you buy it. Think of it, is this making sense to buy a car or house?

Housing loan interest is calculated based on the principal of the loan that you have and the interest is not fixed. Principal of your loan is the amount of money that you still owe the bank.

Car loan interest is calculated based on the total amount of loan that you have and the interest is fixed.

Housing Loan

For example, you borrow $50K from a bank at 5% interest rate for 5 years.

1 year housing loan interest:

- $50K X 5%

- $2,500 (Yearly)

- $2,500 / 12

- $208.33 (First Month)

Depending on the monthly installment amount that you have, let’s say $1K per month, you will reduce your principal from $50K to:

Renew Principal $ after first payment:

- $50K – ($1K - $208.33)

- $49,208.33 (New Principal)

Second month housing loan interest:

- $49,208.33 X 5% / 12

- $205.03 (Second Month)

Total car loan interest rate:

- $6613.70 / $50K X 100%

- 13.23% (Total Housing Loan Interest Rate)

Car Loan

On the other hand, you have car loan of $50K at the interest rate of 5% for 5 years term.

1 year car loan interest:

- $50K X 5%

- $2,500. (Yearly)

- $2,500 / 12

- $208.33 (First Month)

The only difference between the housing loan versus car loan is the car loan interest rate is fixed for every month. Therefore:

First month car loan interest:

- $2,500 / 12

- $208.33 (Second Month)

Total car loan interest rate:

- ($2500 X 5 years) / $50K X 100%

- 25% (Total Car Loan Intereset)

Conclusion

Because the car loan does not reduce the principal amount and the interest is fixed through the year, therefore the interest is higher than the normal housing loan interest calculation provided the interest rates are the same.

So usually what people do when they have housing loan is try to reduce the principal amount as early as possible either by flexible-loan package or early extra payment. It doesn't work for car loan because the interest is fixed and the total interest that your are going to pay is 1.9 X higher than housing loan interest.

You may also want to know that the car value is depreciating every year after you buy it. Think of it, is this making sense to buy a car or house?

Sabtu, 14 Maret 2009

Tax Deduction Incentive for Property – Should I go for it?

The recent news for Malaysian that they may now eligible to claim up to RM10K tax deduction for the loan interest that they pay. I have summarized this news below:

Few things that you may want to consider:

If you’re jobless now or financially not stable, I don’t think you should buy any new properties for the sake of this incentive program. If you have already planned to buy property for quite some times and you’re not jobless now and financially stable, I think you should definitely make use of this tax deduction incentive. Good luck!

- Applicable to all types of properties (i.e. landed house, flat, apartment or condominium)

- Applicable to those who buy the property between March 10, 2009 and Dec 31, 2010.

- Applicable to one property only and to those who buy the property for living (non-rental) purposes only.

- If you’re eligible, you can enjoy this tax deduction incentive for 3 consecutive years.

Few things that you may want to consider:

What if the property value drops after you buy it? Isn’t that possible during this bad economy?Summary

[In my opinion]: I don’t think it will drop. Worst come to worst if it drops, I believe in long term the property will still appreciate down the road. If you scare, you have till Dec 31, 2010 and you can still wait and see the market condition before making any decision.

What if the developer cannot finish the construction as promised after your down payment?

[In my opinion]: Yes, I do think this can happen especially for those not reliable developers. Even for the reliable one, we need to be careful also during this bad economy. So if I were to buy, I would prefer to buy those existing finished construction properties. I don’t dare to buy any still under-construction property, do you?

If you’re jobless now or financially not stable, I don’t think you should buy any new properties for the sake of this incentive program. If you have already planned to buy property for quite some times and you’re not jobless now and financially stable, I think you should definitely make use of this tax deduction incentive. Good luck!

Langganan:

Komentar (Atom)